In May, a junior associate at Bank of America’s investment banking division died suddenly of a blood clot. He had been working 100 hours a week for the past month. Leo Lukenas was an ex-Green Beret who had served multiple tours of duty in the Middle East. Weeks later, another junior associate, Adnan Deumic died of a heart attack at an industry event. He was 25. Make no mistake, the shocking tragedies that befell Deumic and Lukenas were no coincidence: They were worked to death.

Deaths such as these have become all too common thanks to a culture where junior associates are regularly expected to work 15 or 16 hour days and are pressured to underreport their hours to avoid alerting human resources. Such a system can only function with a consistent supply of young talent — drawn in with the promise of obscene amounts of money — that can be churned through and spat out when the bank no longer finds them useful. To supply their talent, the banks turn to Princeton.

Princeton plays the role of the funnel for these banks, finding “talented” young people, training them both to have the skills and the lack of boundaries around work necessary to do these jobs, and guiding them towards roles in these industries.

First, take “finding” talented people. The investment banking and consulting business models rely on the appearance of brainpower to entice clients to spend big on high-cost services of nebulous value. To sell clients, firms source talent exclusively from the upper-echelon of higher education and market their services using the elite credentials of the University. It’s irrelevant to argue the necessity of an Ivy League degree to put together a spreadsheet. Sourcing Princeton graduates is as much a marketing tactic as it is a reflection of their merits.

To find people to market, firms must also convince students that they represent the best option. They do so by selling themselves as the most prestigious and lucrative option — something that will impress their family and friends with immediate name recognition. They do this by cultivating relationships with college career service programs, granting them access to the best tables at career fairs, student email lists, and well-promoted info sessions.

Junior associate positions are also typically sold as a temporary stepping stone to bigger and better things, allowing them to appeal to a wider array of risk-averse students. A survey of Harvard students going into finance and consulting found that only 6.39 percent expected to remain in these sectors long-term. Consequently, firms in these industries rely on a steady stream of new graduates that they can churn through to make their business work. All of this work allows firms to sell themselves as the best option for prestige-conscious students without a clear vision for their future.

Next, Princeton trains students for the cultures like those at Bank of America — by initiating students into the culture of constant work, stress, and responsiveness to authority while in college. Princeton’s academic and social culture naturally funnels students into high-intensity professions: Professors assign too much work in not enough time. Our syllabi cover more content in a shorter 12-week semester. Outside of the classroom, we face intense competition for bicker spots, internships, and even recreational clubs. The Princeton rat-race is perpetual and all encompassing. But somehow we manage it.

Our willingness to put up with this stress culture primes us to accept unreasonable demands from managers and deprioritize self-care in order to keep up with our perceptions of what’s expected of us. Years of experience putting up with these conditions makes us more likely to submit to the brutal schedules that are commonplace in the banking and consulting industries.

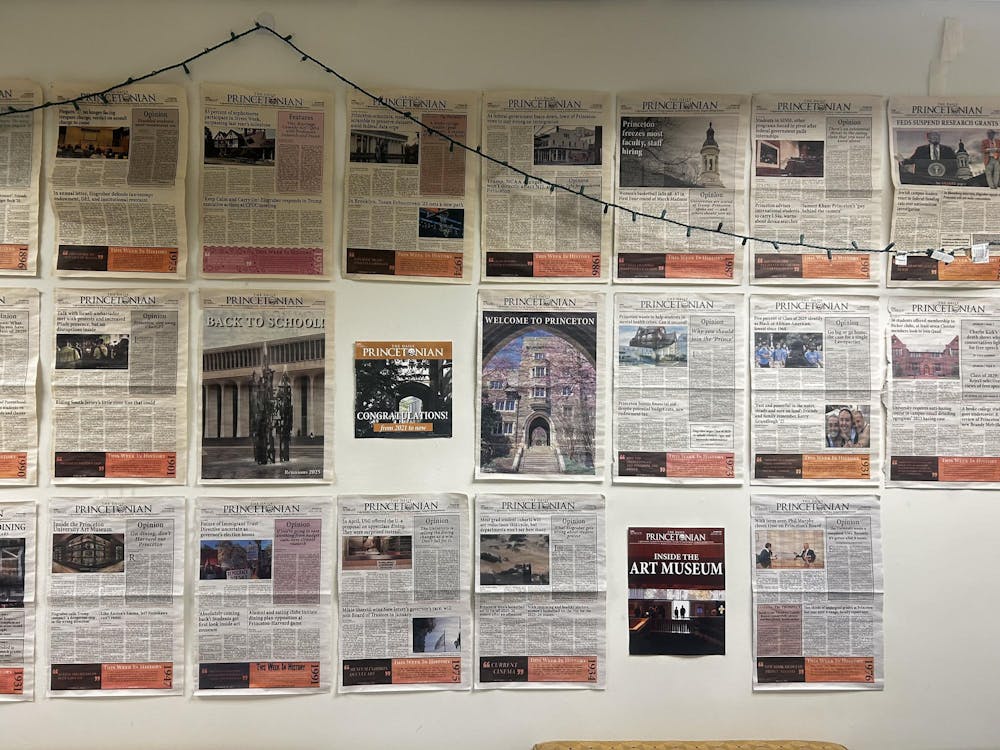

Finally, Princeton funnels students into these kinds of constant-work jobs. The most common sectors represented at last Friday’s Hire Tigers Career Fair were Investment and Portfolio Management followed closely by Management Consulting — two industries notorious for offering excruciating hours in exchange for massive salaries. This heavy recruitment effort pays off — nearly 16 percent of the Class of 2024 went into Finance or Consulting after graduation.

All this effort creates a path of least resistance, a frictionless conveyor that transforms idealistic freshmen into harried alumni—it is the default setting of Princeton. To steer clear of this path requires us to have the wherewithal to change this default. This is harder than it seems.

But we should learn how to change and be able to quit the rat race. Ultimately, Princeton is just a university and banking is just a job. These institutions rely on us just as much as we do on them and we must not let the immediate pressures imposed by the semester define—or imperil—our lives.

You are the axis around which your story revolves; not a class, not a club, and not a career path. If what’s best for you is failing your classes, then fail them. If what’s best for you is taking a leave of absence, then take it. And if after graduation, you find yourself in a job that demands from you an unbearable toll, then get the hell out of there! It might save your life.

Thomas Buckley is a junior from Colchester, Vermont, majoring in SPIA. He can be reached at thomas.buckley[at]princeton.edu. His column "This Side of Nassau" runs every three weeks on Thursday. You can read all of his columns here.