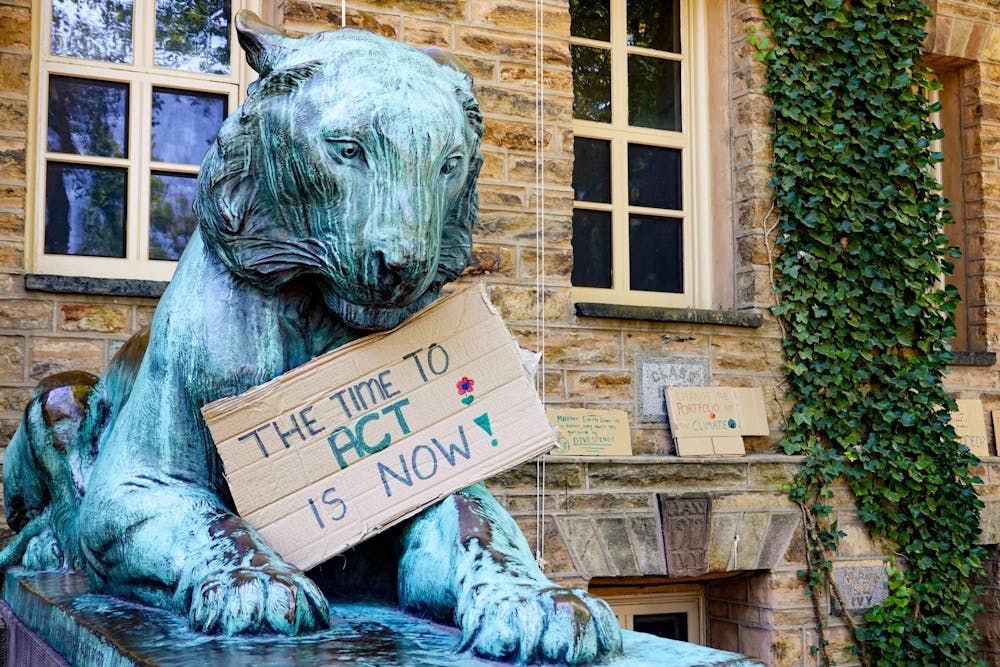

Now that Princeton University has begun a process of fossil fuel divestment by committing to remove publicly traded fossil fuel companies from its endowment, it is time to apply the same logic to the University’s employee retirement plan. All of us in the Princeton community — the Board of Trustees, President Eisgruber, faculty, staff, and students — can contribute to persuading the retirement plan managers, the Teachers Insurance and Annuity Association of America (TIAA) and the Vanguard Group, to divest their funds of fossil fuel companies. In the interim, Princeton should supplement the available options in its retirement plan with a broad selection of fossil fuel-free funds.

According to climate scientists, the urgency of ending our reliance on fossil fuels cannot be overstated. The decades-long failure of high-emitting countries to curb their greenhouse gas emissions means that any hope of capping warming at 1.5–2 degrees Celsius now requires an extremely sharp drop in emissions, starting immediately. In the words of UN Secretary-General António Guterres: “We have a choice. Collective action or collective suicide. It is in our hands.”

The University's retirement plan offers participants several dozen investment options. 32 of the funds have been graded by the shareholder advocacy group As You Sow for their exposure to fossil fuel companies. As of April 26, with nine Fs and 16 Ds, these 32 funds score a D average.

TIAA's investment in fossil fuels has been estimated at more than $78 billion out of its $1.4 trillion portfolio. It has another $772 million invested in deforestation-risk agribusiness companies. These companies operate in regions such as the Amazon basin and Indonesia, producing palm oil and rubber. TIAA is also the fourth-largest holder of coal-related bonds, including approximately $70 million in bonds of Adani, which recently developed the Carmichael coal mine in Australia after years of environmental opposition. Last year, 299 TIAA plan members confronted this reprehensible record in an 87-page formal complaint about TIAA’s violations of the Principles for Responsible Investment, of which TIAA subsidiary Nuveen is a signatory.

Mutual funds that consider social values such as climate impact — often labeled Environmental, Social, and Governance (ESG) — are scarce at TIAA. Of well over 100 funds that TIAA manages, only seven are marketed as “ESG-focused.” The University's retirement plan offers just one, the CREF Social Choice R3 (QCSCIX). Although not rated by As You Sow, this fund, despite its characterization as ESG-focused, has holdings in fossil fuel companies ConocoPhillips, TotalEnergies SE, Shell PLC, and others totaling over $400 million. ConocoPhillips is driving the controversial Willow oil drilling project on Alaska's north slope, the largest pristine wilderness area in the U.S.

Educators across the country are challenging TIAA to live up to its claim to “champion green initiatives, address environmental justice and lead our industry in modeling sustainable behavior” and its recognition that “climate risk is investment risk.” Our faculty and staff should join those at Cornell, SUNY, Rutgers, and other universities to pass a resolution urging TIAA to fully divest their funds of fossil fuels. The American Federation of Teachers, representing 1.7 million members, has also passed a similar resolution, and a recent op-ed called for a faculty resolution at Harvard.

In the short term, all of us who participate in the University’s retirement plan must be given a choice on whether to invest in climate destruction. Many funds with A grades on climate are available outside TIAA, although careful vetting is needed to avoid greenwashing, when companies present themselves as doing good for the environment when they aren’t. We urge the administration, faculty, and staff to work together to make sustainability the default and to offer a broad set of such funds to employees. In the context of today's climate crisis, the University's responsibility to its students must include striving to safeguard their future and standing with them as they fight for a livable planet.

Signed by:

Eve Aschheim, former Director, Senior Lecturer, Visual Arts, Lewis Center for the Arts

Ruha Benjamin, Professor, African American Studies

Allison Carruth, Professor, Effron Center for the Study of America and High Meadows Environmental Institute

Zahid Chaudhary, Associate Professor, English

Curtis Deutsch, Professor, Geosciences and High Meadows Environmental Institute

Andrew Dobson, Professor, Ecology and Evolutionary Biology

Karen Emmerich, Associate Professor, Comparative Literature

Denis Feeney, Professor of Latin, Classics, Emeritus

Eddie Glaude Jr., Professor and Chair, African American Studies

Anthony Grafton, Professor, History

Kenneth Hammond, Research Physicist, Princeton Plasma Physics Laboratory

Aleksandar Hemon, Professor, Creative Writing

Brooke Holmes, Professor, Classics

Karl Kusserow, John Wilmerding Curator of American Art, Princeton University Art Museum

Rena Lederman, Professor, Anthropology

Anne McClintock, Professor, Gender and Sexuality Studies and High Meadows Environmental Institute

Peter Meyers, Professor, Physics

Naomi Murakawa, Associate Professor, African American Studies

Barbara Nagel, Associate Professor, German

Rob Nixon, Professor, English and High Meadows Environmental Institute

Dan-el Padilla Peralta, Associate Professor, Classics

Susan Sugarman, Professor, Psychology

Keeanga-Yamahtta Taylor, Professor, African American Studies

David Wilcove, Professor, Ecology and Evolutionary Biology and Public Affairs, and High Meadows Environmental Institute

Jerry Zee, Assistant Professor, Anthropology and High Meadows Environmental Institute