When board members of the Cap & Gown Club sought town approval to build an addition to the clubhouse six years agothat would cost around $5 million, town officials raised half-hearted concerns about a proposed tap room.

At a Princeton Regional Planning Board meeting in 2009, they asked: Why would Cap want to build a tap room if it lacked a liquor license? Board members responded that club members “are allowed to bring their own alcoholic beverages.”

Concerns about the tap room were short-lived. Overall, the 5,175 square foot project seemed like a great addition to Cap’s social facilities, and the Planning Board approved the project unanimously, happy that the rear addition “harmoniously related in style and material” to the existing building and left the club’s historic facade untouched.

The two-floor addition consisted of a large dining hall with a vaulted wood ceiling on the first and a new tap room in the basement with a “custom millwork bar” and a refrigerating room, labeled “KEG” in the architect’s plans. Expanded patio and terrace areas for “outdoor entertainment events” would also be built.

But when it was time for the club to pay the town the final fees to get the social addition approved, payment checks did not come from Cap.

Instead, an educational foundation known as the Princeton Prospect Foundation — established exclusively to “stimulate and encourage the love of learning and pursuit of knowledge” at Princeton’s eating clubs — footed two bills for a total of $30,985.50, part of the cost of obtaining a building license for the tap room, dining hall and terrace, according to copies of the checks obtained through public records requests.

The money had been collected by the Foundation from tax-deductible contributions paid to the “Prospect Foundation - Cap & Gown Club Fund.”

The funds came from donors who were virtually all club alumni — alumni who would have been unable to take a tax deduction had they donated directly to the club. The incentive worked both ways. Without tax-deductible donations, it would have been more difficult for the club to fund the project.

That same year, the Prospect Foundation funneled an additional $1.6 million in funds to pay for Cap’s renovation and expansion project. In 2010, it sent over an extra $2.7 million. The entirety of these funds were labeled for “educational purposes” by the Foundation and were tax-deductible.

This way of fundraising — using foundations to give tax deductions that the clubs themselves cannot offer — is common to the Prospect Avenue clubs. Otherwise known as the Street, these clubs are the places where Princeton undergraduates party at night and where upperclassmen eat and socialize during the day. The clubs also house dedicated study spaces.

An investigation started in 2013 by The Daily Princetonian has found that the Prospect Foundation and a handful of other foundations funneled millions of dollars in tax-deductible contributions over the past few years for social, non-educational purposes at the eating clubs. Internal Revenue Service guidelines specifically bar these kinds of expenses.

The ‘Prince’ reviewed thousands of pages worth of tax returns, identified individual donors and conducted interviews with club board members, donors and independent lawyers.

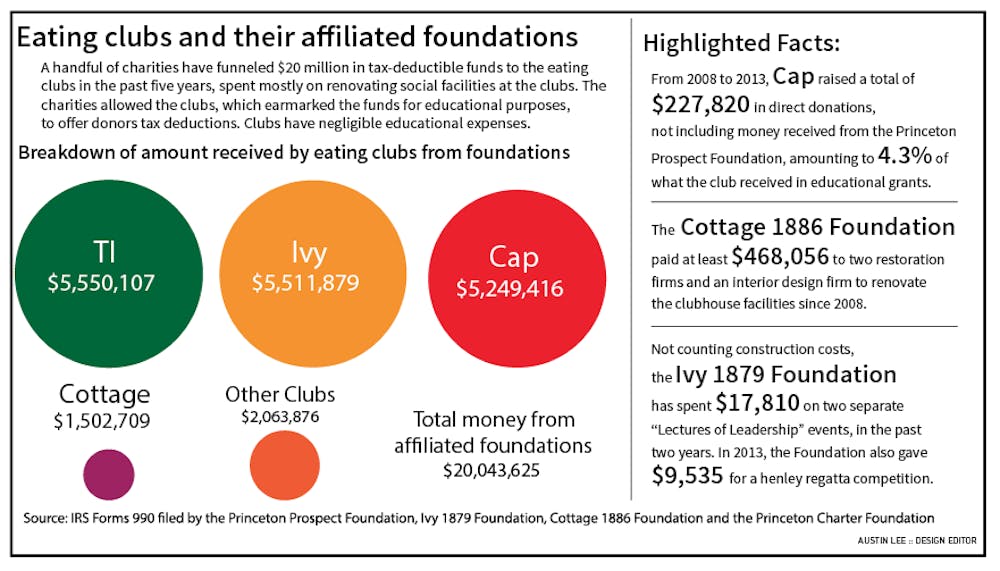

Most notably, the investigation found that, since 2008, alumni donors have received tax deductions on $20 million worth of charitable donations that were eventually funneled to the eating clubs, the vast majority of which went to non-educational projects. These funds have been used to pay for the construction and renovation of eating club social facilities, such as dining halls, kitchens, lounges, sleeping quarters and other social spaces — none of which qualify as educational donations under IRS guidelines.

“The eating clubs at Princeton walk, talk, quack like exclusive private clubs,” said Dean Zerbe, a lawyer at Alliantgroup who worked for many years as counsel to the U.S. Senate Committee on Finance on tax legislation issues and who reviewed key records used in this story. “It raises real questions about whether the foundations supporting the eating clubs should benefit from charitable status and that the eating clubs should benefit from subsidies by the American taxpayer.”

Some of the key findings of the ‘Prince’ review include:

- Three clubs — Cap, Ivy Club and Tiger Inn — have received the lion’s share of the educational funds, a combined $16.3 million in tax-deductible contributions. This sum was used to pay for new dining facilities at Cap and TI. While Ivy did build a new library with tax-deductible money, it also built a much larger lounge, labeled the Great Hall, paid for from the same source of money.

- The eating clubs have raised little money directly in comparison to the educational contributions that have been funneled by the foundations to the clubs, according to a review of IRS records. TI and Cap raised a combined $629,000 in direct donations since 2008. Ivy raised $11,839. These funds did not involve tax deductions.

- Four educational foundations approved by the IRS exist solely to pass on educational funds to the eating clubs. These are the Prospect Foundation, the Ivy 1879 Foundation, the Cottage 1886 Foundation and the Princeton Charter Foundation. The existence of foundations to support, exclusively, the educational activities of the eating clubs is legal. All four foundations have negligible expenses outside of supporting their affiliated clubs.

- The Prospect Foundation went through an IRS audit in 1998, and the results of the audit put in place tailored regulations to explicitly prevent the disbursement of funds for non-educational purposes. Yet, according to interviews and a review of records, the Prospect Foundation has aggressively interpreted the regulations put in place 17 years ago and routinely funded the construction of social spaces, even though those are specifically barred by its agreement with the IRS.

- The Cottage 1886 Foundation has directly spent close to $1.7 million in tax-deductible funds in the past five years to pay for the regular maintenance of the entire University Cottage Club clubhouse under the incorrect assumption, said legal experts consulted by the ‘Prince,’ that the status of Cottage as a historic clubhouse makes its maintenance expenses charitable. Cottage has been listed on the National Register of Historic Places since 1999.

- In 2010, TI failed to disclose in its annual balance sheets the receipt of a $4 million contribution from the Prospect Foundation that was used to pay for the construction of a dining hall addition. Instead, it said it had received a total of close to $47,000 in donations.

- The rest of the clubs have received a combined $2 million from the four foundations since 2008. The use of these funds is harder to identify, and the individual amounts much smaller. The clubs do have certain educational expenses, according to interviews and records reviewed. Cannon Club has not received any foundation funds.

The eating clubs consider the possibility of a tax deduction a selling point for donors, too.

“The mission of Princeton Prospect Foundation, from day one, has been overwhelmingly to be the tax-exempt vehicle for receiving donations,” said Sandy Harrison ’74, current chairman of both Terrace Club and the Prospect Foundation, the largest of the four educational foundations that currently exist exclusively to support the eating clubs.

Eight of the 11 eating clubs have individual accounts within the Prospect Foundation which collect money from alumni donations and can only be touched by the respective eating clubs.

Harrison said the Prospect Foundation has strict guidelines in place and a specific grants committee to ensure that funds are disbursed for the right causes — those considered educational by the IRS. They cannot pay for tap rooms, he said, but he maintains that dining halls and kitchens are fair game.

John Bruestle ’78, a Prospect Foundation trustee, characterized the grants committee members as “sticklers” when it comes to “following the guidelines.”

“There are some alumni who do pay contributions directly to the club,” Harrison added. “But the majority of the donations, certainly the big ones, are going to pass through the [Prospect Foundation] because donors want to be able to get the tax deduction.”

However, lawyers interviewed for this story as well as IRS documents reviewed, paint a different picture of what expenses an eating club can claim to pass off as educational in nature and, as a result, offer a tax deduction. A review of records and series of interviews conducted by the ‘Prince’show that foundations can only fund activities and facilities that are exclusively educational, mainly libraries and computer clusters. Dining facilities are explicitly not allowed.

Tax experts consulted said that if the IRS were to examine the donations and grants and conclude that some of them were improper, such a determination could lead to the foundations losing their tax-exempt status. Potential violations involving nonprofits generally carry a three-year statute of limitation, lawyers noted, a period of time that in most of these cases has already passed.

Individuals who have obtained tax deductions by donating to the construction campaigns of their former eating clubs through these foundations include the CEO of an S&P 500 company, prominent University donors and University trustees.

“If you can’t get a deduction for making a contribution directly to the club because it is a social organization, then funneling that same dollar amount to the club for the same non charitable purposes, it seems to me as just not an acceptable way of doing business,” said Peter Dickson ’73, a local tax lawyer who has also served as a preceptor at the University. Dickson reviewed all IRS filings and legal documents used in this story.

‘IRS guidelines are pretty liberal’

The main issue lies in IRS regulations about what can entitle donors to tax deductions and whether social clubs may also engage in educational activities.

According to tax regulations, the eating clubs are institutions organized for “pleasure, recreation, and other similar purposes.” They pay no federal income tax, although they do pay local taxes and cannot offer tax deductions for contributions.

Fraternities and sororities, including their Princeton chapters, are also organized in this manner, as are other clubs, like the Princeton Club of New York.

Eating clubs are different from charities, such as the University, which can process tax-deductible donations. In order to achieve charity status, the IRS requires prospective organizations be “organized and operated exclusively” for religious, charitable, scientific, testing for public safety, literary, educational or prevention of cruelty to children or animals purposes.

To offer tax deductions, the organization must serve a public rather than a private interest, a regulation that exists in tension with the mission of a social club which, the IRS says, should serve private interests.

The membership of a social club “must be limited,” the IRS adds. “Evidence that a club’s facilities will be open to the general public” may be a reason for the IRS to deny a prospective organization a social club status.

The foundations affiliated with the eating clubs are all charities organized for educational purposes.

“The phrase ‘education’ or ‘educational’ is defined in IRS regulations as instruction on matters that are useful to the individual … as indicative of an intentionally structured plan to convey knowledge,” said Marcus Owens, a partner at law firm Loeb & Loeb and a former director of the Exempt Organizations Division at the IRS, which oversees all nonprofit organizations. “A casual dinner conversation is not structured around any particular goal, other than a pleasant dining experience.”

But the clubs’ informal relationship with the University, lawyers said, opens a window of possibility for the legitimate existence of educational activities at the clubs, such as occasional lectures.

This situation is not unique to the University and has been replicated in the case of many sorority and fraternity houses around the country, which Owens noted were equivalent to the eating clubs in terms of their IRS status.

At least two IRS publications have tried to draw clear lines to separate the educational from the social when a foundation is created to support a fraternity or sorority.

“Laundry facilities, dining areas, sleeping quarters, dedicated social and recreational areas and mixed use areas are NOT permissible” as educational grants, reads one of the documents. “There is a direct nexus between providing these facilities, services, or goods and the social and recreational aspects of a fraternity.”

The document, titled “Fraternity Foundation Grants,” asks IRS agents to pay attention to grants earmarked for facilities when they audit fraternity foundations.

The document explained permissible grants would be for “dedicated study areas, wiring, individual computers, computer desks and computer chairs.”

A separate document conveyed the same message.

“A grant to a fraternity for the building or general renovation of a fraternity chapter house would not be in furtherance of a [charitable] purpose,” the document said.

Cap’s addition consisted of a new dining hall and a tap room. TI’s addition included a dining hall, a tap room and two new dormitories for undergraduate officers. Other than the addition, TI also performed some renovations to its library and to its computer room. Over the past five years, the two clubs received a combined $10.8 million from the Prospect Foundation for their construction campaigns.

TI graduate board chair Hap Cooper ’82 declined to comment for this story.

“You’ve got a situation there where I think the Foundation has overstepped the statute,” Owens said. “Clearly you’ve got [an] issue in which the IRS would be very interested, frankly, whether the Foundation is funding the non-educational aspects of the eating clubs, and it certainly sounds like [the Foundation is] being very aggressive.”

Board members of the eating clubs and the foundations have vehemently denied any case of impropriety, noting that the clubs do in fact organize sporadic educational activities and that, in their view, the IRS takes a broad approach to what can be considered educational.

“[IRS] guidelines are pretty liberal,” Bruestle, who is also the chair of the Charter Club’s graduate board, said. “They include certain aspects of the kitchen and dining facilities because they are being used to feed students and also allow real estate taxes and insurance.”

Harrison and other eating club board members interviewed took a similar position.

“Eating clubs do serve educational functions — for example, if there are libraries where there is a lot of studying that goes on,” Harrison said. “You have to eat, so if you order improvements to the kitchen, that is considered educational.”

None of the eating club board members interviewed provided documentation to support their statements. When asked, Harrison said there was no doubt in his mind about his interpretation of what the IRS considers educational.

“I am the chairman of the Princeton Prospect Foundation, so I am sure, yes,” he said.

Representatives of Ivy and the Ivy 1879 Foundation wrote in a joint statement that the club “serves an educational function in addition to its social function.”

“Ivy 1879 Foundation was established specifically for the purpose of providing the Club with financial assistance in fulfilling its educational function,” wrote Ivy graduate board treasurerCorbin Miller ’71 and 1879 Foundation presidentJohn Cook ’63.

While Ivy did build a library, it also built a much larger social hall that was funded through the Ivy 1879 Foundation. One of the architects of the project, James Bradberry, described the construction on his website as including “new lounges and a social hall, renovations to food service areas, a ground floor library, and outdoor terrace/landscape improvements.”

Thomas Letizia, a lawyer hired to represent Ivy before the Planning Board in 2005 when it sought town approval for its addition, described the construction project in similar terms, according to the minutes of the meeting.

“The applicant is proposing an 8,270 square foot addition to be used as a social gathering space,” the minutes read.

Miller and Cook explained in the statement that their actions were the result of legal counsel.

“We do not feel ourselves to be under any moral obligation to utilize the Foundation in this regard to a lesser extent than that permitted by applicable law,” they wrote.

Seminars and periodicals

For all the money that is coming in to the clubs from the affiliated foundations, lawyers who reviewed the clubs’ financial disclosure forms said that there is little evidence that the clubs are spending much on education.

“If you go through the list of expenses for the clubs, the vast majority of the expenses are for meals, for salaries for the people who work in the clubs, for social events,” Dickson said. “I just don’t see any educational expenses listed or anything that is capable of being an educational expense.”

For example, Cap spent $2,225 on “seminars” and $1,980 on “periodicals” in 2010 — the only educational expenses that year, according to its IRS returns — the same year it received $2.7 million from the Prospect Foundation in “educational grants.”

The Ivy 1879 Foundation has funded two “Lectures on Leadership”for the past two years for a combined cost of $17,810. A new “Lecture on Leadership” took place Thursdaywith the participation of embattled former CIA director David Petraeus GS ’87. In 2013, the 1879 Foundation also gave $9,535 to support a Henley Regatta competition.

TI has not reported any educational expenses in its IRS returns.

Meanwhile, the Cottage 1886 Foundation has not funneled money to Cottage. Instead, it has spent money directly on the club’s behalf.

In the past five years, the 1886 Foundation has directly spent close to $1.7 million, reportedly for “lecture programs, seminars, cultural events and the enhancement of library facilities,” as well as to work on the “restoration and preservation” of the clubhouse, according to the Foundation’s general description of expenses in its IRS returns filed since 2008.

The specifics of those educational expenses are unknown.

But the 1886 Foundation has paid three firms, Masonry Preservation Group, C&H Restoration and Renovation, and J.K. Kling Associates, a combined $468,056 in restoration and interior design fees since 2008 while granting their donors tax deductions, according to a section of their returns that requires disclosure of certain independent contractors.

The Foundation is only required to disclose its independent contractors when it pays them more than $100,000, so not all of such expenses are necessarily known.

“The Cottage 1886 Foundation was established in 1999 specifically to fund the Clubhouse’s escalating maintenance costs and capital expenditures,” reads a brochure prepared as part of a Cottage fundraising campaign launched in 2010 to establish a permanent endowment for the club. “We encourage all of our alumni to designate the Cottage 1886 Foundation as one of the charities to which he or she donates a modest amount in each of the next few years.”

The brochure does not mention any 1886 Foundation sponsorship of lecture programs, seminars or cultural events.

The club has listed amongits charitable expensesevery year since 2008 the need to “restore and repair the exterior of the building [and of] the historically and architecturally significant interior public areas.”

Cottage also unsuccessfully fought a nine-year legal battle in New Jersey to obtain historic status in the state, a recognition that would have allowed the club to avoid paying property taxes to the town of Princeton.

Dickson said it was misguided to consider that repairing a clubhouse would count as a charitable or educational pursuit, even if it is a historical landmark.

“My private house can be on the National Register of Historic Places,” Dickson said. “That will not let me deduct the money I spend fixing up my house or putting up a new roof because that is a private purpose.”

According to the National Park Service, the federal organization that oversees the National Register, tax incentives do exist, but they are different from the tax deductions that the 1886 Foundation offers its donors.

Cottage chairman Carlos Ferrer ’76 and 1886 Foundation chairman James Crawford ’57 did not respond to a request for comment.

Terrace obtained Planning Board approval in 2014 for an addition that includes a dining room to seat the expanding membership all at once, a music room in the basement for shows and a new deck. The addition will require the club to raise $3.5 million.

Harrison, current chairman of both the Prospect Foundation and Terrace, said the club planned to use the Foundation for the “vast, vast majority of donations.”

Meet the donors

The ‘Prince’ traced the identity of the donors of a total of $5.86 million donated to the foundations using text-searchable versions of family foundation IRS returns through the online databases Citizen Audit and Foundation Center.

The list includes donors big and small, but some of the largest ones correspond to prominent businessmen, University donors and University trustees.

Celgene CEO and University Trustee Robert Hugin ’76 donated $513,315 to the Prospect Foundation in 2011 through his family foundation. Hugin is also a Prospect Foundation trustee.

William Ford ’79, executive chairman of the Ford Motor Company, donated $250,000 to the Ivy 1879 Foundation in 2005, during the early stages of Ivy’s capital campaign.

Shelby Davis ’58, a prominent University donor, contributed $1 million to TI’s renovation project, according to its website. At least half of his contribution carried a tax deduction, paid in 2010 to the “Prospect Foundation - Tiger Inn Account” by his family foundation, called the S and G Foundation.

Dennis Keller ’63, prominent University donor and co-founder of the for-profit educational corporation DeVry, Inc. donated $200,000 to Cap in 2009.

Only Davis responded to a request for comment.

“I believe eating clubs are part of the educational experience at Princeton just like lacrosse, rowing, the arts, etc., all of which raise money for facilities under the Princeton banner,” Davis said.

A Ford Motor Company spokesperson declined to comment on Ford’s behalf.

The chair of the University Board of Trustees, Katie Hall ’80, one of two people after whom the Cap tap room is named, did not respond to requests for comment asking whether she received a tax deduction for her gift. Neither did Bill Powers ’79, the co-sponsor of the tap room.

All eating club officials interviewed for this story said that the foundations could not fund tap rooms.

Donors interviewed echoed Davis’ sentiment. In their view, the eating clubs are part of life at the University and part of a larger educational experience.

“I have always, since my undergraduate days, considered the clubs an integral part of the University,” said Roger Sachs ’64, who has donated to the Prospect Foundation. “In my mind, there has been no distinction between donating to my club or to Annual Giving. Likewise, I see upgrades and improvements to club facilities as a legitimate use of donations.”

Peter Singer, a philosophy professor at the University who is also an advocate of donating to charity, said he did not consider donations to the eating clubs to be particularly charitable or educational. He said he was worried, instead, that these donations only benefited those who are already wealthy.

“The taxpayer in this case is subsidizing people who are already wealthy and whose interest is in benefiting other people who are already wealthy,” Singer said. “I think that that is unethical and I think eating clubs should not be taking advantage of that. They are clearly stretching a point here.”

The audit and the agreement

The Prospect Foundation was once the subject of an audit by the IRS, an examination that “threatened to end the foundation’s tax-exempt status,” the ‘Prince’ reported at the time.

The results of the 1998 audit were put in writing in a Collateral Agreement, signed the same year, that instituted a series of regulations specific to the Prospect Foundation in order to allow the organization to maintain its charity status. The agreement was negotiated by a tax lawyer, Robert Haines ’61, who was hired to solve the matter but was previously unaffiliated with the Foundation.

Haines became a trustee of the Prospect Foundation two years after successfully reaching the agreement and eventually became its chairman until his retirement in 2014.

He provided the ‘Prince’ with a copy of the agreement in 2013.

The Collateral Agreement accepts that the eating clubs engage in some educational activities that the Prospect Foundation is legally allowed to fund, but attempts to create specific guidelines to distinguish those activities.

“The line that this memorandum was attempting to draw is that charitable contributions could be solicited and used to maintain that library or study room, but could not be used for the rest of the facilities, which were social in nature,” Owens, the former director of the IRS tax-exempt division, said after reviewing the document.

[scribd id=263978250 key=key-hg8K0RyRMhxATE4nuFKB mode=scroll]

Bill McCarter ’71, current Cap legal counsel and the chairman of the club during the early stages of its renovation campaign, said the club had requested and relied on a legal opinion to justify the use of the Prospect Foundation.

The opinion, dated 2006, concluded that the Prospect Foundation was within its rights to fund the club’s new dining hall, but not the tap room.

The opinion was signed by Haines on the letterhead of his firm, Herold & Haines. At the same time, he was also the vice chairman of the Prospect Foundation, the educational nonprofit that, his opinion concluded, was allowed to fundraise for his client’s capital campaign.

“It is, therefore, our opinion that the Foundation can fund dining room facilities,” Haines wrote at the end of his 300-word opinion.

McCarter said he did not see a potential conflict of interest in the situation.

“He was the one who negotiated the settlement with the IRS and knew more about it than anyone else on the planet,” McCarter explained.

A close examination of Haines’ legal opinion, lawyers said, shows that he misinterpreted the Collateral Agreement and at least one other tax provision.

The crux of the issue is spelled out on two paragraphs of the Collateral Agreement. One describes a test to determine whether a project can be funded by the Prospect Foundation. The test uses the example of a roof, saying that the Foundation can only fund a roof if it will cover an area that will be used at least 50 percent “solely and entirely for educational activities.”

In that case, only the educational percentage can be funded. If less than 50 percent of the project is educational, then the Foundation is unable to fund any percentage of the project.

However, in his legal opinion, Haines cites a different paragraph of the agreement, which said that the Foundation may not fund a “Club’s food and drink, food and drink services.” He concludes that the agreement bans services but says nothing about facilities.

“The Collateral Agreement barred funding ‘food and drink and food and drink services’ but did not bar ‘food facilities,’ ” Haines wrote in the opinion.

“That seems to be just a misreading,” Owens said. “If you look at paragraph 4 of the IRS agreement, facilities generally don’t qualify. It has to be facilities used entirely for educational purposes. And so the lawyer’s opinion is going beyond the plain language of the agreement and extrapolating from the agreement … from a place that cannot be sustained on audit, that is, the IRS would challenge that conclusion.”

[scribd id=263898031 key=key-LZBvRHdk00ChRxE8iRos mode=scroll]

Dickson raised some of the same issues upon his review.

“No matter how you look at it, the Foundation is not allowed to make a contribution to non-educational activities or facilities,” he said. “And the example that is given in this agreement is a facilities example.”

Haines also cited an IRS ruling — which can be used as precedent by taxpayers — as part of his conclusion. The ruling says that an educational nonprofit may fund “a training table for coaches and members of a university’s athletic teams,” including the funding of certain meals.

“He is not interpreting the revenue ruling correctly,” Owens said. “The reason that the sports’ teams dining facility does qualify as an appropriate educational activity … [is based] on the assumption Congress has made that athletic activity in a university setting is an educational activity.”

The eating clubs count many varsity athletes among their members, but club membership is open to all University students.

McCarter, himself a lawyer, said he never checked the opinion that Haines gave him.

“I was his client. He gave me a legal opinion. I’m entitled to rely on his legal opinion that he gave me in good faith,” McCarter said.

Haines did not respond to more recent requests for comment with questions about his legal opinion and the agreement.

“[The agreement] is a signal that if the IRS returns to conduct another examination, they are virtually certain to review those same issues,” Owens said. “And the degree of the adherence to how the IRS would interpret that collateral agreement is going to be important.”

Asked about these observations in writing, Harrison released a one-sentence statement affirming that the Prospect Foundation has always played by the rules.

“Princeton Prospect Foundation adheres at all times in good faith and with proper documentation to the provisions and underlying intent of the specific 1998 IRS collateral agreement with [the Prospect Foundation] in its determination of which eating club expenses are considered educationally-related and the extent to which such expenses may be paid from [Foundation] funds,” he wrote.

He said as much in an earlier interview.

“Keep in mind that the IRS, after that 1998 agreement which was 17 years ago and counting, they haven't challenged anything, or come back or even audited us,” Harrison said. “And we don’t want to even tempt that to happen so we try to play by the book.”