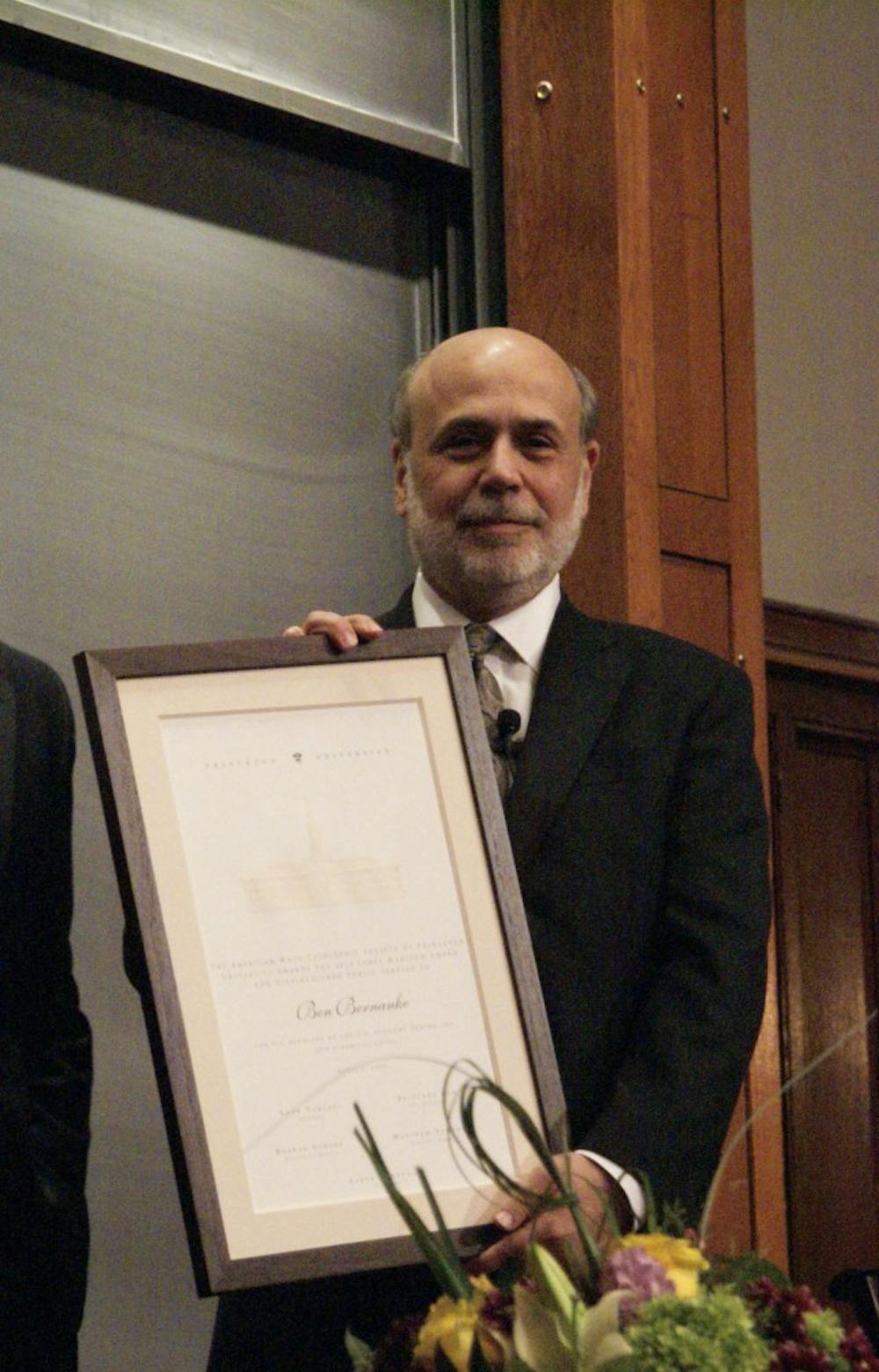

Ben Bernanke, former Chairman of the Federal Reserve and former chair of the economics department, was presented with The American Whig-Cliosophic Society's 2014 James Madison Award for Distinguished Public Service in a ceremony on Wednesday.Bernanke followed the ceremony by discussing his time at the Federal Reserve as well as his time in academia with economics professor Alan Blinder ’67, who served as vice chairman of the Federal Reserve from 1994-96.

Bernanke said his legacy includes an increased transparency within the Fed, noting that during his time as chairman he appeared on ‘60 Minutes’ and granted requests for interviews with the media to inform the public about monetary policy.

“Democratic legitimacy requires that [the Fed] explain itself,” Bernanke said. “Particularly during the crisis … it was very important just from a democratic point of view to go out and try to explain that the Fed was trying to do the right thing for the economy.”

Bernanke also said that financial stability had become a central goal of the Fed during his tenure as chairman, explaining that it had been restructured to suit that purpose by working more closely with Congress and administrators to instigate change. Bernanke noted that in explaining the impending financial crisis to Congress and administrators, he had attempted to avoid overstating the crisis by comparing it to the Great Depression, drawing on many historical examples from Japan, Switzerland, the United Kingdom and the Eurozone.

“I wanted to be strong enough and scary enough to get action, but on the other hand, I didn’t want to overstate the case,” Bernanke said. However, he added that looking back, he said he might have understated it.

Finally, Bernanke said, monetary policy had largely changed during his tenure, noting as examples quantitative easing and the AIG bailout decision. Quantitative easing is a process whereby a central bank increases the monetary base by buying financial assets from commercial banks.

“In the middle of a big fire, you don’t start worrying about fire code,” Bernanke said of the often unconventional methods used by the Fed during the financial crisis.

Bernanke explained that if he had had a genie and three wishes back during his time at the Fed, he would have wished for more equal access to skills and opportunities, which could combat inequality; tax code reform to make the Fed more accessible; and immigration policy reform, particularly in the recruitment of high-skilled and entrepreneurial immigrants.

However, Bernanke warned against hindsight bias in looking at the actions of the Fed before and during the financial crisis.

“There was a very strong opinion that markets were the best,” Bernanke said of the time period before the financial crisis. “That really worked in some areas like airlines, for example. Financial markets are a little different.”

Bernanke said that if he were to teach ECO 101: Introduction to Macroeconomics, he would emphasize practical knowledge of financial panics, instability, regulation and literacy.

“It’s very important for people to understand on a personal level the financial industry, the issues of income, saving and so on,” Bernanke said. “The goal of economics is to be as useful as dentistry.”

Bernanke also noted that he had little political experience before joining the Fed, his political experience being limited to a six-year stint on the Montgomery Township school board.

“There are many, many paths to public service,” Bernanke said. “The best way is to follow your hopes and aspirations. Maybe like me, one day you won’t be paying attention and something happens.”

Bernanke spoke to a full audience in McCosh 50 at 4:30 p.m. on Wednesday.