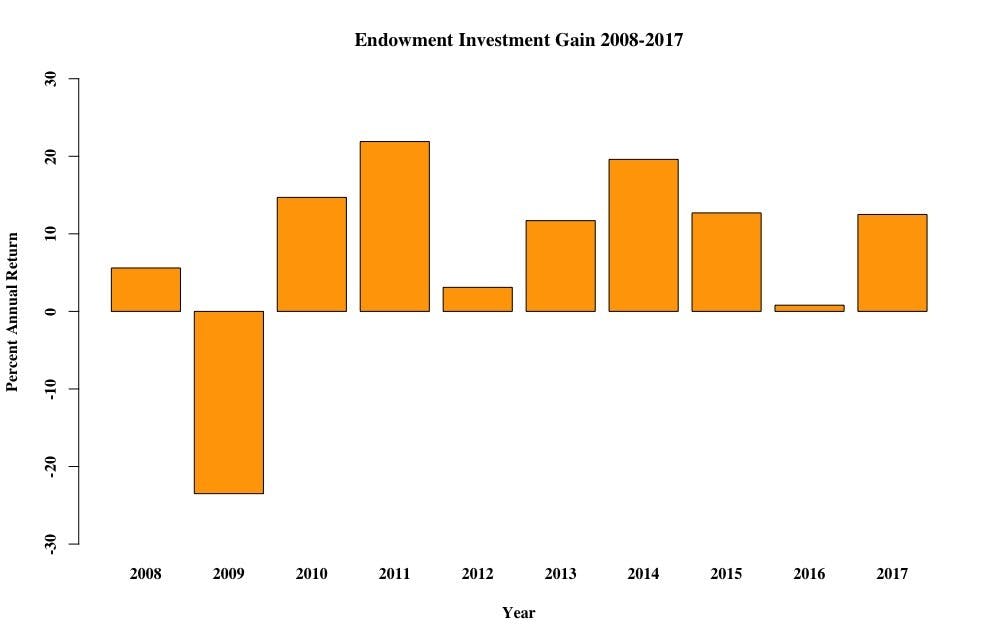

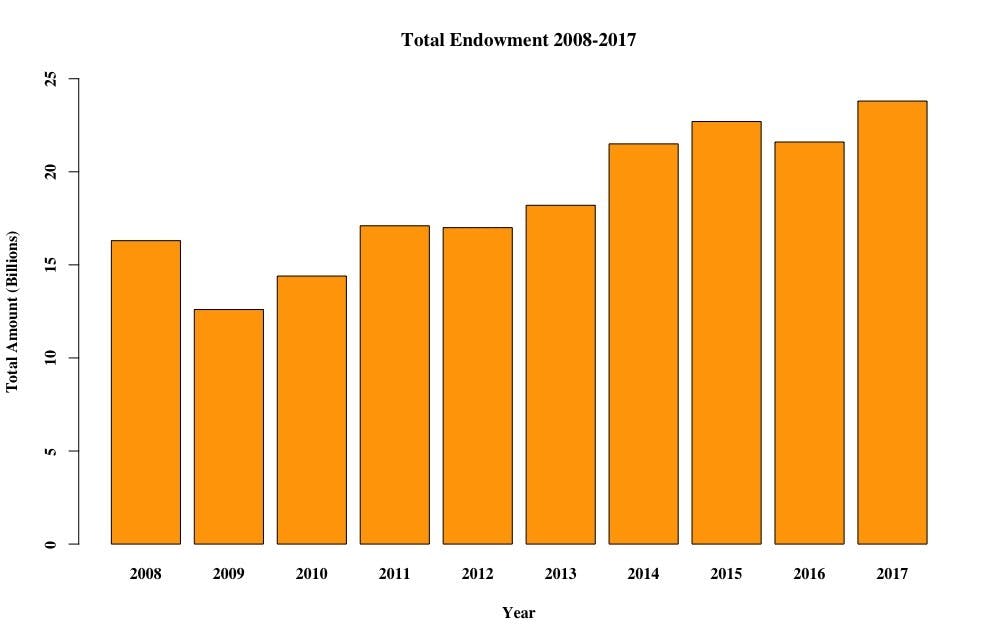

The University released its endowment returns on Monday afternoon, Oct. 9, and showed a 12.5 percent investment gain for the fiscal year ending June 30, 2017. The endowment is now valued at $23.8 billion, a growth of $1.6 billion from last year, when the University reported only a 0.8 percent return.

“I have mixed feelings about it,” said Princeton University Investment Co. (PRINCO) president Andrew Golden. “We care mostly about the returns in absolute terms, as that is certainly what enables us to achieve our goals.”

PRINCO manages the endowment, and will certify the results during its directors’ meeting on Oct. 19. According to a University statement, the endowment’s average annual return during the past decade is 7.1 percent, placing the University squarely in the top percentile of the 458 institutions listed by the Wilshire Trust Universe Comparison Service.

Harvard University announced its returns in mid-September, noting only an 8.1 percent return for Fiscal Year 2017. Although that brought Harvard’s endowment to a staggering $37.1 billion, the returns were disappointing to N. P. Narvekar, the new manager of the Harvard Management Company, the analogue to PRINCO.

Columbia University and Yale University have yet to release their endowment returns, while Dartmouth College posted a 14.6 percent return, and Stanford University reported a 13.1 percent return.

“On the relative front ... you can’t win every year, so to speak,” Golden continued, “and, in fact, that’s not really what this is about.” Golden, who has managed the endowment since 1995, explained that for PRINCO – and for most endowment managers – the job is to manage for the long-term, although this was not PRINCO’s strongest year in relative terms.

“One year is kind of the blink of an eye,” Golden added.

“Everyone who works at PRINCO cares about higher education, and this is not the same kind of [zero-sum] competition as a football game,” he said. “We think that we all do well when we all do well.”

Golden said that he feels good about long-term prospects for the endowment, “in part, because we’re long-term.” He noted that he works closely with administrators and the Board of Trustees to establish and support long-term goals, and support the work the University does best.

“We do perform well and that performance has enabled us to create a financial aid program that’s second to none and pay for a lot of other forms of excellence and research and teaching – all while spending it in appropriate amounts,” Golden explained.

The University statement noted that 80 percent of its financial aid budget is covered by endowment funds. The Board of Trustees approved an 8.7 percent increase in undergraduate financial aid, to a total of $161.2 million, in the University’s operating budget, part of the University’s effort to increase the student body’s socioeconomic diversity.

“Over the past 10 years, [our investment returns] have been somewhat low, but that includes a global financial crisis the likes of which we had not seen since the 1920s and 1930s,” said Golden. “I think I’m pretty confident that as the global financial crisis rolls off, we’ll see higher performance.”

Global business cycles aren’t the only challenge Golden has faced in the past decade. Congress and some U.S. senators have been criticizing colleges and universities with endowments greater than $1 billion for not spending enough of their returns. Last April, for example, Congress requested information from the University about its spending of endowment returns. The U.S. Senate Finance Committee even proposed legislation requiring that colleges and universities spend a minimum percentage of their endowments.

In reference to tax policy on endowments, Golden emphasized having an eye for the long-term.

“It’s not something you want to yank around each year,” Golden said.

Additionally, Golden explained that compensation packages for the PRINCO team, including himself, are based on long-term performance, just like the endowment’s goals. Many universities now run their endowments through separate companies like PRINCO and HMC, largely so universities don’t have to report compensation information on Form 990s, which are public documents.

“A lot of compensation is tied to how well we do, but it focuses on a multi-year period,” he said. “Otherwise, it would be focused on folks thinking about short-term investing instead of long-term issues.”

The endowment is composed of permanently restricted net assets, temporarily restricted net assets, and unrestricted net assets – and has thousands of accounts dating as far back as the University’s founding. Most accounts are dedicated to financial aid purposes.

The University set another record this year in annual giving, raising $74.9 million with 56.8 percent of alumni participating. While unrestricted gifts from annual giving go directly into the operating budget, restricted gifts add to the endowment.

Head Opinion Editor Nicholas Wu provided graphics.